Portfolio Backtest

#1 AI-Powered Portfolio Backtesting Tool

Create your first backtest in seconds. Let our AI-powered portfolio backtester help you find tickers, set weights, compare stock portfolios, analyze returns, and optimize your investment strategy quickly and easily.

Trusted by Professional Investors

Portfolio Backtest helps investment professionals backtest portfolio strategies in seconds. Our portfolio backtester makes stock portfolio backtesting fast and accurate.

“I can test a portfolio concept in under a minute. Portfolio Backtest finds the right tickers, sets the exact weights, and creates the backtest for me. It's my go to tool for running backtests.”

How Portfolio Backtest Works

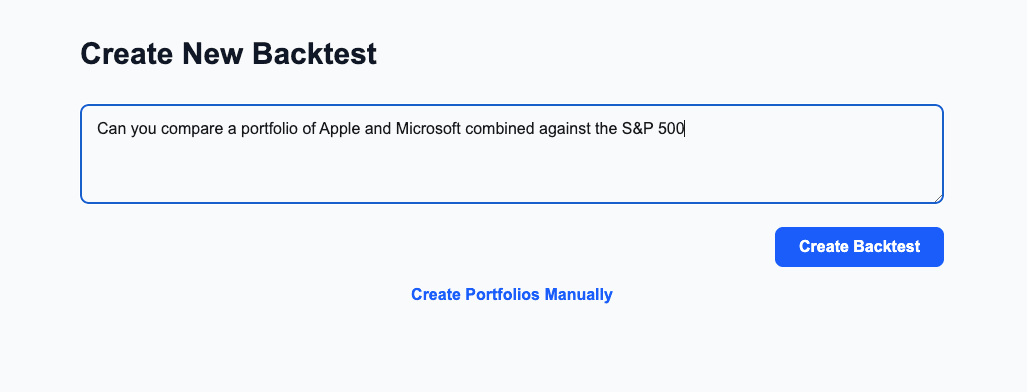

Describe Your Portfolio Backtest

Write the portfolios you want to backtest in plain English. Our guided prompts help you find the right tickers and weights instantly for your stock portfolio backtesting needs.

AI Analysis

Leverage AI to turn your description into real portfolios you can compare over time. Get accurate ticker selection and weighting so you can backtest portfolio strategies in seconds with our portfolio backtesting tool.

Get Results

Receive comprehensive performance metrics and visualizations of your portfolio backtest. Every run captures detailed portfolio backtesting insights you can share with clients or teammates.

Stock Portfolio Backtesting Made Simple

Describe The Portfolios You Want to Backtest

Use our portfolio backtest tool to ask questions like "Compare a portfolio of 50% Apple and 50% Microsoft against the S&P 500 over the last 20 years" and get instant stock portfolio backtesting results.

Compare Portfolio Metrics Across Time Periods

Get detailed metrics from your portfolio backtest including returns, volatility, sharpe ratio, and drawdown analysis. Our portfolio backtesting tool provides comprehensive performance insights.

Track Portfolio Value Over Time

Track your stock portfolio's performance over time with interactive charts and visualizations from your portfolio backtest.

Break Down Portfolio Returns By Year

Analyze annual performance from your portfolio backtesting with detailed breakdowns of returns for each year. See how your stock portfolio performed year over year.

Track Portfolio Drawdowns Over Time

Monitor and analyze drawdowns from your portfolio backtest to understand your stock portfolio's risk profile and performance during market downturns.

Frequently Asked Questions

Still have questions? We're here to help.

Contact supportSimple, Transparent Pricing

Start with a 7-day free trial. Choose the plan that fits your portfolio backtesting needs. All plans include AI-powered backtest creation and performance analytics.

Standard

Perfect for getting started with portfolio backtesting

$19/month

- Manual backtest creation

- 10 years of historical data

- 10 backtests per month

- Advanced portfolio metrics

- Email support

Pro

For active investors who need more capacity

$29/month

- AI-powered backtest creation

- 500 AI credits per month

- 20 years + of historical data

- 50 backtests per month

- Advanced portfolio metrics

- Email support

Premium

For serious and professional investors

$59/month

- AI-powered backtest creation

- 1000 AI credits per month

- 20 years + of historical data

- Unlimited backtests

- Advanced portfolio metrics

- Priority email support

Ready to Test Your Portfolio Strategy?

Create your first backtest in seconds with the help of AI

Create Your Backtest